profhimservice44.ru

Prices

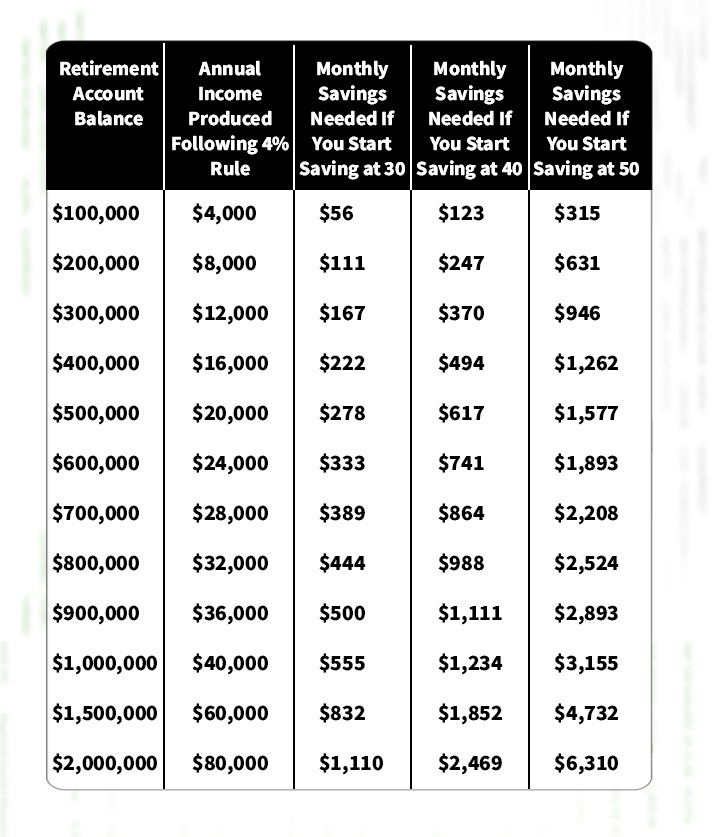

How Much Do I Need To Live On In Retirement

One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and. To move beyond the averages, people's retirement budget should factor in how they're used to living—that is, what their pre-retirement income affords them. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at This is sometimes called “replacement income.” So if you made $50, a year while employed, you should have at least $40, per year available to spend during. 1. How much will you need to spend? One school of thought says you'll need 75% to 80% of your current income to maintain your present standard of living. Annual Income Required (today's dollars) · Number of years until retirement · Number of years required after retirement · Annual Inflation · Annual Yield on Balance. Someone between the ages of 18 and 25 should have times their current salary saved for retirement. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and. To move beyond the averages, people's retirement budget should factor in how they're used to living—that is, what their pre-retirement income affords them. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at This is sometimes called “replacement income.” So if you made $50, a year while employed, you should have at least $40, per year available to spend during. 1. How much will you need to spend? One school of thought says you'll need 75% to 80% of your current income to maintain your present standard of living. Annual Income Required (today's dollars) · Number of years until retirement · Number of years required after retirement · Annual Inflation · Annual Yield on Balance. Someone between the ages of 18 and 25 should have times their current salary saved for retirement. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks.

For instance, a person making less than $50, a year before they retire might need to replace 80% of their preretirement income on average in retirement, and. It's hard to put an exact figure on how much a person might need, but it's fair to say that you will need at least 40% of your current salary to ensure your. 1. You don't have to do it alone. · 2. Create a retirement "vision"—and potential budget. · 3. How do your estimated expenses and income affect your decision to. Experts suggest you aim for 2/3 of your current income once you retire. To enjoy the lifestyle you've chosen, we estimate you'll need (after tax each year). Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. There are lots of figures floating about, but financial experts generally recommend the two thirds rule – for a comfortable retirement, your total pension needs. One rule of thumb is that you may need 80% of what you make now in retirement, but unexpected things could sink your retirement ship if you don't plan ahead. A study of actual retirement cost found that while spending in retirement ranges from %,that most retirees use 70% or less of their former income. You'll. Contrary to what many financial planners suggest, you can live on a lot less than % or even 80% of your pre-retirement income. In fact, a survey by T. The amount you need to retire depends on your desired lifestyle, location, and how long you expect to live in retirement. A common rule of thumb is the “ Average income around $k, so assuming a 30 year retirement it's around $$2M, ballpark. There's about 4 pages worth of nuance to. A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. Retirees can expect to spend 70% to 80% of their pre-retirement income in retirement, according to one rule of thumb. Older Americans spent an average of. The average retirement income for a single person over age 65 is roughly $42, per year. That income may come from Social Security, pensions, and other. The Pensions and Lifetime Savings Association has suggested three Retirement Living Standards – minimum, moderate and comfortable – based on research by. When should I start saving? Ah, the key question. One rule of thumb is that you'll need 70% of your pre-retirement yearly salary to live comfortably. That. According to the Northwestern Mutual Planning & Progress Study, the average person in their 40s has $77, saved for retirement. People in their 60s have. Life insurance calculator How much do you need? Life insurance resources Use this retirement income calculator to determine how much monthly retirement income. You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If you save 5% of. If you plan to maintain your current lifestyle, some experts say you should plan to spend % of your current income in retirement to cover your standard.

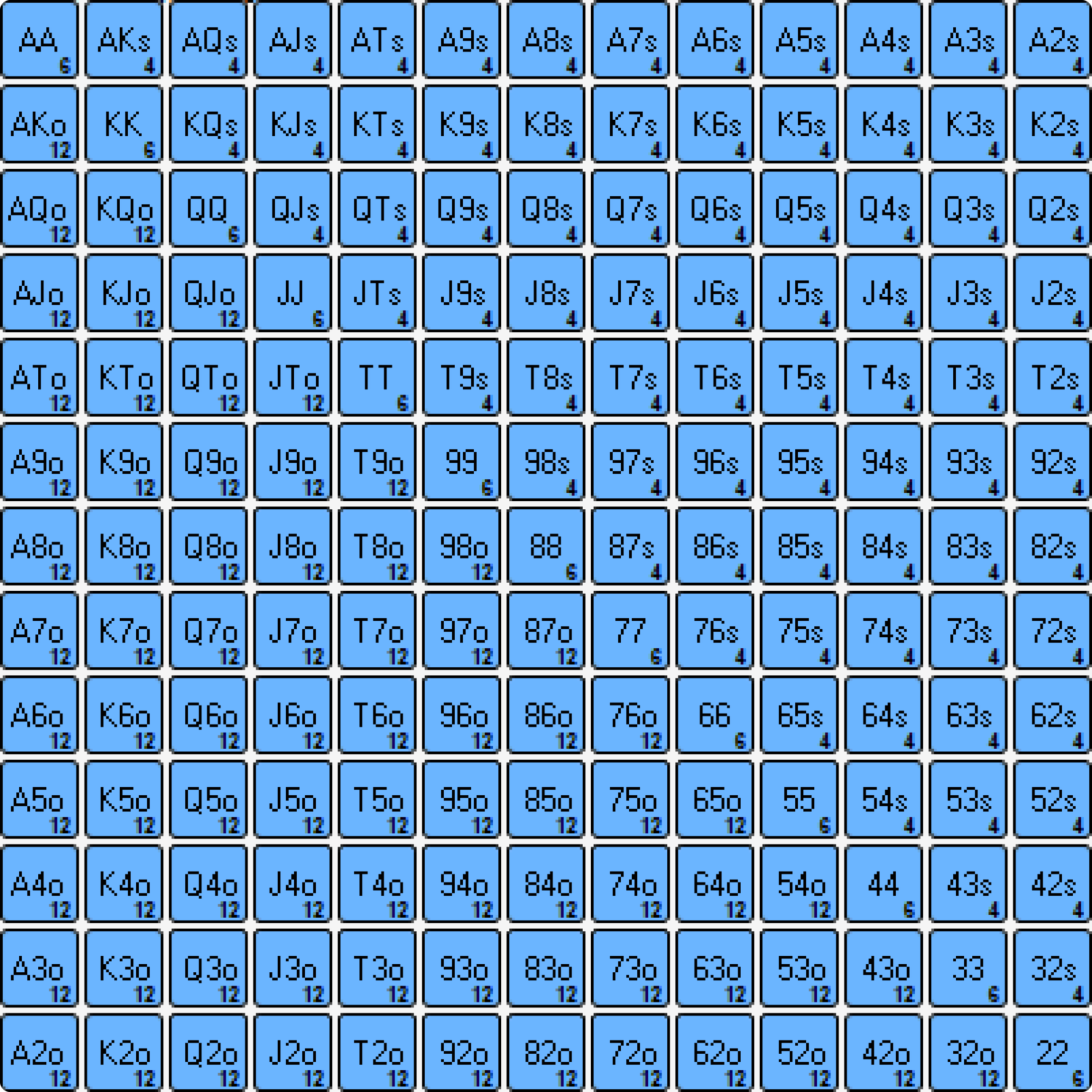

Poker Multiplier Chart

The calculator will return the strategy decision with the highest EV, as well as the 2nd best alternative and chance of all possible hands. Extensive selection of live games. Quantum Blackjack Plus – Playtech; Lightning Blackjack – Evolution; Regular On-Table Promotions and Free Chips. 4 / 5 Stars. Calculating Poker Odds for Dummies - A FREE, #1 guide to mastering odds. How to quickly count outs to judge the value & chance of winning a hand in When there's only 2 or 3 people who know how to play it at the table, you can win a lot by getting the bonus multiplier. poker table of people. The best strategies With the correct strategy, poker becomes an easy game. Prize Pool Multiplier, $1 Spin & Go First-Place Prize, Frequency. 3,, $3, Every Thursday & Sunday, invited local's exclusive 10x points on slots & video poker guaranteed. No limit! On many of your favorite games. Learn how to calculate poker pot odds in an easy to follow process from one of the most successful poker pros. Includes a free poker pot odds chart! Thursdays in April - With the Mystery Multiplier, you could win up to 20X Infinity Rewards points on all video poker and reel slot machines. multiplier. The blind level structure of each BLAST Sit & Go is based on the drawn multiplier according to the following table: Prize Pool Multiplier - 2 and 5. The calculator will return the strategy decision with the highest EV, as well as the 2nd best alternative and chance of all possible hands. Extensive selection of live games. Quantum Blackjack Plus – Playtech; Lightning Blackjack – Evolution; Regular On-Table Promotions and Free Chips. 4 / 5 Stars. Calculating Poker Odds for Dummies - A FREE, #1 guide to mastering odds. How to quickly count outs to judge the value & chance of winning a hand in When there's only 2 or 3 people who know how to play it at the table, you can win a lot by getting the bonus multiplier. poker table of people. The best strategies With the correct strategy, poker becomes an easy game. Prize Pool Multiplier, $1 Spin & Go First-Place Prize, Frequency. 3,, $3, Every Thursday & Sunday, invited local's exclusive 10x points on slots & video poker guaranteed. No limit! On many of your favorite games. Learn how to calculate poker pot odds in an easy to follow process from one of the most successful poker pros. Includes a free poker pot odds chart! Thursdays in April - With the Mystery Multiplier, you could win up to 20X Infinity Rewards points on all video poker and reel slot machines. multiplier. The blind level structure of each BLAST Sit & Go is based on the drawn multiplier according to the following table: Prize Pool Multiplier - 2 and 5.

Three Card Poker shall be played on a standard blackjack table having eight places on one side for the players and the player-dealer, and a place for the house. Earn 20/30 hours weekly and activate a 2x/3x multiplier on ALL high hands! View Rules. Blackjack hand of cards and casino chips. Mystery Gridiron Giveaway. multipliers that were awarded while the Ultimate X feature was turned on. For example, here is a sample multiplier table for Jacks or Better: Hand. Multiplier. Poker SchoolHouse Rules. Cash Game. Texas Hold'emOmaha6+ Short Deck. Unique Multiplier, 1st Prize, 2nd Prize, 3rd Prize, Frequency / M Games. x40, In this lesson we focus on drawing odds in poker and how to calculate your chances of hitting a winning hand using basic math and several shortcuts. Poker Hands are sets of between one and five cards that can be played in Balatro to obtain Chips and Mult for scoring. Each hand also has a level that. Hands up, who here uses Video Poker strategy charts when playing in casinos We LOVE A Big Hand With a Multiplier! We LOVE A Big Hand. And when the bonus multiplier kicked in (when everyone at the table strategy to playing the hands (something I should have looked into. poker and reel slot machines. Valid on video poker and reel slot machines Map · Lost & Found / Safety · About GSR · Careers · GSR Cares · Minority Owned. Multiplier and Poker Points not valid for this promotion. Must be 50 years or older. Complete rules available at the Rewards Center. Image of each Rewards. Click on one of the following games to see that game's pay table and theoretical financial return for perfect play. During each round of play, players are dealt cards from a standard card deck, and the goal of each player is to have the best 5-card hand at the table. It is a stud poker game using one deck of 52 cards. The table can accommodate seven players; each position has three spaces marked Ante, Play and Pair Plus. card hand. Download Rules. $20K Slot Tournament Ocean Casino Resort. 15x Free Play Multiplier. Activate Your Multiplier. Saturday, September As stated in the Help page, the Hot Roll Feature occurs once out of every 6 games. There will be two dice rolled to determine the multiplier for the payout. The. Rules: 3 card poker is played between the player's hand and the dealer's hand. This hot table game is fun but also easy to play. Learn how to play 3 card. This table reflects all Scratchers prizes for this game. After game start, some prizes, including top prizes, may have been claimed. Odds are rounded to the. The winner takes all, except for when one of the top three multipliers is hit. See the payout table for details. RANDOMLY DETERMINED PRIZE POOL: The cash prize. This is something that will help you tremendously at the poker table, especially if achieving the best poker winrate (big blinds won per hands), is your. The spinner in the center of the table Level length. The length of each blind level in a Spin & Go tournament depends on what prize pool multiplier is drawn.

Transfer Money To Ira

You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA (except a Roth IRA) or to an employer-sponsored retirement plan . An IRA rollover is a way of moving your tax-deferred retirement savings from one account to another. · If a distribution is made directly to you, you must. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. If you have multiple IRAs and you want to pull money from more than one IRA and move it to your HSA, you have to first transfer the money from one IRA to the. A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. With an IRA to IRA transfer, or a trustee to trustee transfer, you never take possession of the funds, so you don't pay taxes. Learn about your options for depositing or transferring money to your Fidelity accounts, including IRA contributions, college savings plans. Click "Accounts & Trade" and select "Transfer" · Navigate to the "Deposit, withdraw, or transfer money" link · Choose the appropriate accounts. A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider. You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA (except a Roth IRA) or to an employer-sponsored retirement plan . An IRA rollover is a way of moving your tax-deferred retirement savings from one account to another. · If a distribution is made directly to you, you must. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. If you have multiple IRAs and you want to pull money from more than one IRA and move it to your HSA, you have to first transfer the money from one IRA to the. A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. With an IRA to IRA transfer, or a trustee to trustee transfer, you never take possession of the funds, so you don't pay taxes. Learn about your options for depositing or transferring money to your Fidelity accounts, including IRA contributions, college savings plans. Click "Accounts & Trade" and select "Transfer" · Navigate to the "Deposit, withdraw, or transfer money" link · Choose the appropriate accounts. A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider.

A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. It depends. Generally, amounts already invested in American Funds in an employer-sponsored retirement plan can be rolled over into an IRA invested in American. Directed IRA will initiate transfer requests from an existing IRA within 3-business days of receiving your completed transfer form. Transferring assets other. For asset transfers involving assets that you hold outside of a retirement account, such as in a regular taxable brokerage account or taxable mutual fund. You can fund most IRAs with a check or a transfer from a bank account. Take these actions to begin building a balance in your retirement account. Move your money without triggering a taxable event, continue to benefit from your savings' tax-advantaged status, and resume contributing to your savings. IRA transfers involve the same type of retirement plan moving from one firm to another. For example: moving a traditional IRA from ABC Bank to a traditional IRA. To roll over your (k), you'll transfer your money to a Fidelity IRA. You may need to open an IRA if you don't already have one to roll over your account. A transfer is a direct movement of assets from one IRA to another IRA. Transferring assets prevents you from actually receiving the money when it comes out of. Provide basic investment details: This helps us tailor your investment options. · Choose Mutual Funds for your Traditional IRA · Provide personal details · Move. A rollover is when you move funds from one eligible retirement plan to another, such as from a (k) to a Traditional IRA or Roth IRA. Rollover distributions. Generally speaking, you can move funds from one plan to another and still retain the tax sheltered status of the funds. Most clients establishing a self. Some transfers can take 4 to 6 weeks, but your wait could be shorter. You'll get a more accurate estimate when you start your transfer online. In most cases, you can call your IRA provider or request money online. Depending on what you own in your account, the funds might go out as soon as the next. How a transfer of assets works · You submit your transfer request 5–7 minutes · We provide your request directly to your firm · Your firm processes the request and. If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method. Easily set up one-time or repeating cash transfers or make IRA contributions · Move cash from your Chase account or an external bank account · Move cash between. Options can include (a) a spousal rollover (if the beneficiary is the spouse of the plan participant), (b) establishment of an “inherited IRA” account either. Rollover your account from your previous employer and compare the benefits of Brokerage, Traditional IRA and Roth IRA accounts to decide which is right for you. Transfer an IRA · Consolidating investments may make investing, allocating, and tracking performance easier · Consider opening a new IRA · Transfers will appear on.